The ruling by the EU General Court means that the coffee chain will not have to pay millions of euros in back taxes to the Netherlands.

The Netherlands and Starbucks: The Case in Summary

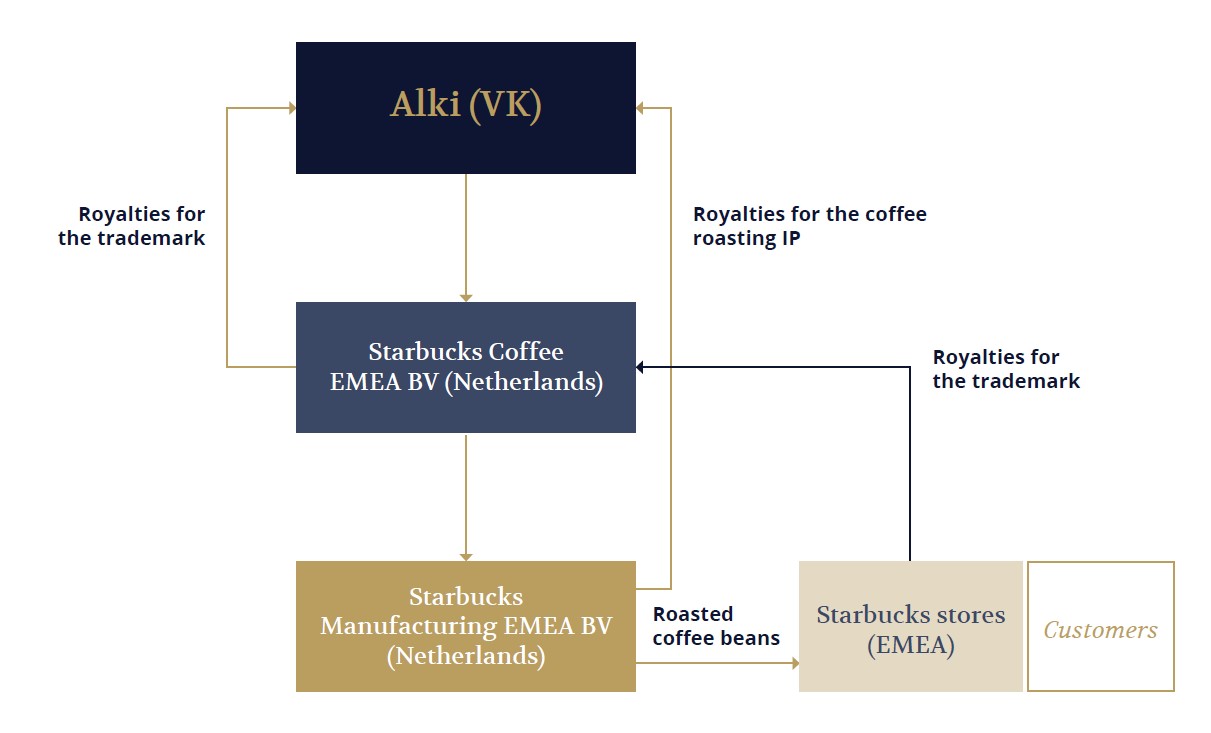

Starbucks EMEA is a Netherlands-based subsidiary of the Starbucks group, which consists of Starbucks Corp. and all entities under its control. Starbucks Corp. is headquartered in Seattle, Washington. Alki LP is a UK-based subsidiary of the Starbucks group exercising indirect control over Starbucks EMEA. Alki and Starbucks EMEA concluded a contract for the roasting of coffee beans, the chief clause providing that Starbucks EMEA pay a royalty to Alki for the use of intellectual property rights owned by Alki, including the coffee roasting recipe and other know-how related to coffee roasting.

On 28 April 2008, the Dutch tax authorities entered into an Advanced Pricing Agreement (APA - a type of tax ruling) with Starbucks EMEA, the purpose of which was to determine the compensation Starbucks EMEA had to pay for its production and distribution activities within the Starbucks group, as defined in the APA. The APA was valid for the period starting 1 October 2007 and ending 31 December 2017, its main use being to simplify the company's annual corporate tax returns in the Netherlands.

What is state aid?

State aid concerns favourable measures implemented by Member States in violation of Article 107 of the EU Treaty. Any such aid (or State resources) would distort or threaten to distort competition by favouring certain undertakings or the production of certain goods, thereby affecting trade between Member States.

State aid in the form of taxation measures is presumed if the four following conditions are fulfilled:

- The measure is taken by and imputable to a Member State and financed through State resources;

- It confers a selective economic advantage on certain undertakings or the production of certain goods ("selectivity requirement");

- It distorts or threatens to distort competition;

- It may affect trade within the EU.

State Aid and a Ruling

According to the European Commission, a tax ruling may be a concealed form of state aid if the transfer pricing method applied results in transfer prices not at arm's length, the outcome thus not being in agreement with economic reality and the amount of corporate income tax being too low. The tax ruling as an instrument per se is not an issue.

What was the European Commission's decision?

The European Commission had concluded that the corporate tax arrangement constituted illegal state aid, judging that it fulfilled the four conditions listed above.

What is the EU General Court's judgment?

The European Commission tried to demonstrate the existence of an advantage in favour of Starbucks by proposing six lines of reasoning. However, the EU General Court held that the European Commission had been "unable to demonstrate" that the APA issued by the Dutch tax authorities constituted an economic advantage within the meaning of Article 107(1) of the EU Treaty.

The EU General Court found that the TNMM instead of a more direct Transfer Pricing method did not carry enough weight to prove the existence of a selective economic advantage. In order to determine the arm's length principle, the EU General Court examined the functional analysis and the comparability analysis of the Netherlands and Starbucks captured in the APA.

The consequence is that not all four conditions for state aid can be fulfilled, meaning that the arrangement does not qualify as state aid.

The EU General Court's ruling ensures that Starbucks will not have to pay millions of euros in back taxes to the Dutch government.

And the Fiat Case?

In contrast to Starbucks and the Netherlands, state aid has been established in the Fiat and Luxembourg case. In the Fiat case, the EU General Court did not accept a remuneration on a hypothetical amount of capital at risk, instead of the total amount. Therefore, Luxembourg had not acted in line with the arm's length principle resulting in a selective economic advantage for Fiat.