Update of the blog dated 16 October: in the vote of 22 October, the European Parliament rejected the negotiating basis on the terms approved by the Legal Affairs Committee. This means that the Omnibus proposal will now be considered by the European Parliament during the next plenary session on 13 November. It gives Members of Parliament the opportunity to propose further amendments to the Omnibus text in advance of the final vote. Therefore, the negotiating position – in advance of the trilogue negotiations between the Commission, Parliament and Council – may differ from the position set out by the Legal Affairs Committee, creating a prolonged uncertainty.

Following the plenary session of the European Parliament on 13 November, we will know the timeline for amendments to be submitted. These amendments may encompass further changes to the anticipated position on the CSRD, CSDDD and the EU Taxonomy Regulation. Negotiations between the Commission, Parliament and Council are anticipated thereafter. While the objective remains to reach final agreement by the end of 2025 or early 2026, the timeline is becoming increasingly constrained, and the European Parliament’s position remains unclear. We will continue to closely monitor the legislative process in Brussels.

Introduction

The EU Green Deal continues to be reshaped through a series of legislative revisions. One of the revisions relates to the Corporate Sustainability Reporting Directive (CSRD). As a short recap, early 2025, the European Commission published the two “Omnibus” packages, intended to adjust both timelines and certain substantive obligations across the EU Green Deal frameworks (see i and ii).

On 14 April 2025, the “Stop-the-Clock” Omnibus Directive was formally adopted. This granted a two-year deferral to the companies that needed to report in Wave 2 and Wave 3. On 23 June 2025, the Council of the European Union (the Council) adopted its final position on the second Omnibus proposal.

Earlier, we provided an overview of the most relevant proposed amendments to the CSRD and CSDDD resulting from the Stop-the-Clock Proposal. In this ESG update, we will (i) concisely address the most important items of the final position of the Council regarding the CSRD and (ii) focus on the differences between the Stop-the-Clock Proposal and the Council’s final position. The Council’s final position is to be considered a formal response to the EU Commission’s second Omnibus proposal.

The Council’s Final Position and Thresholds

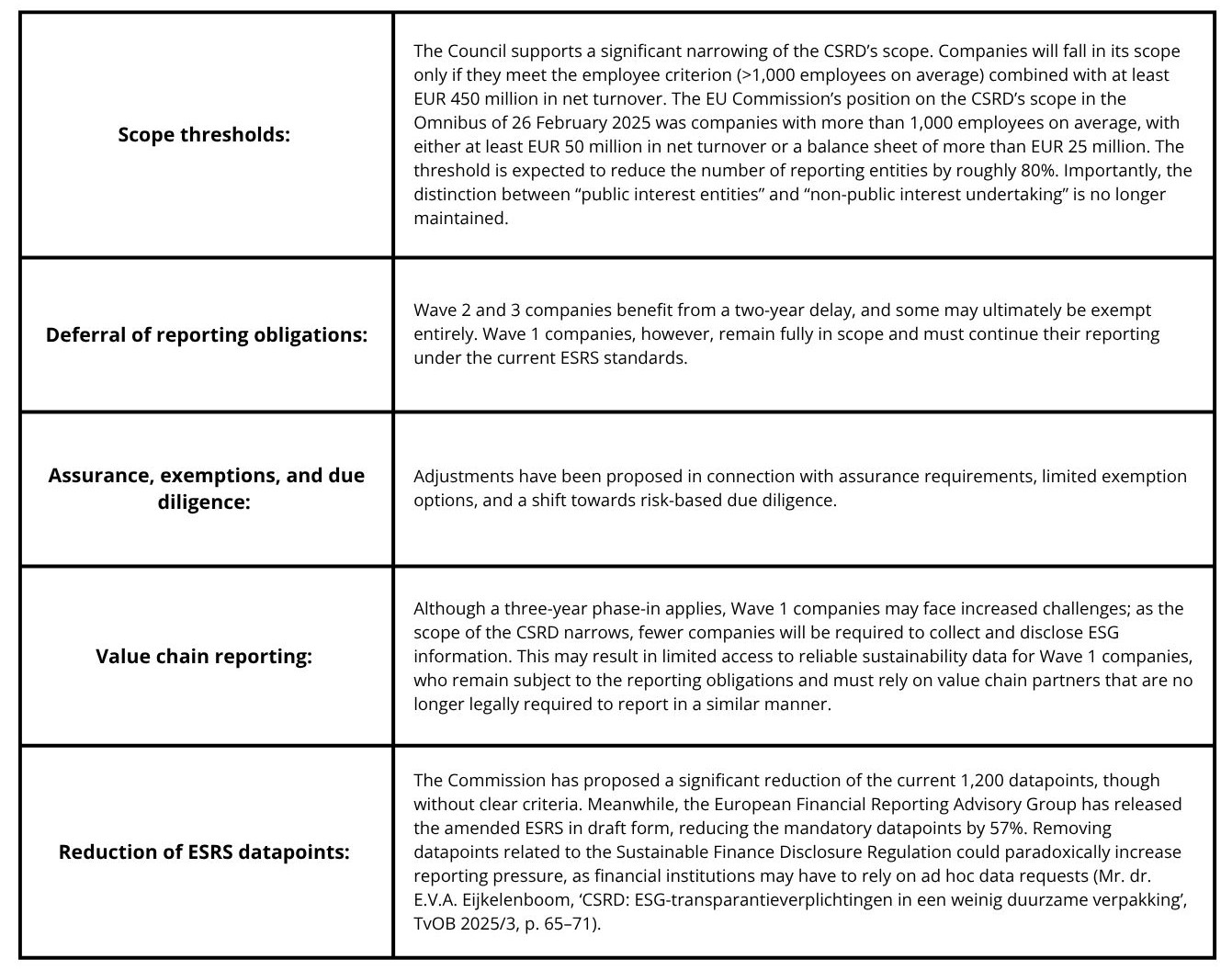

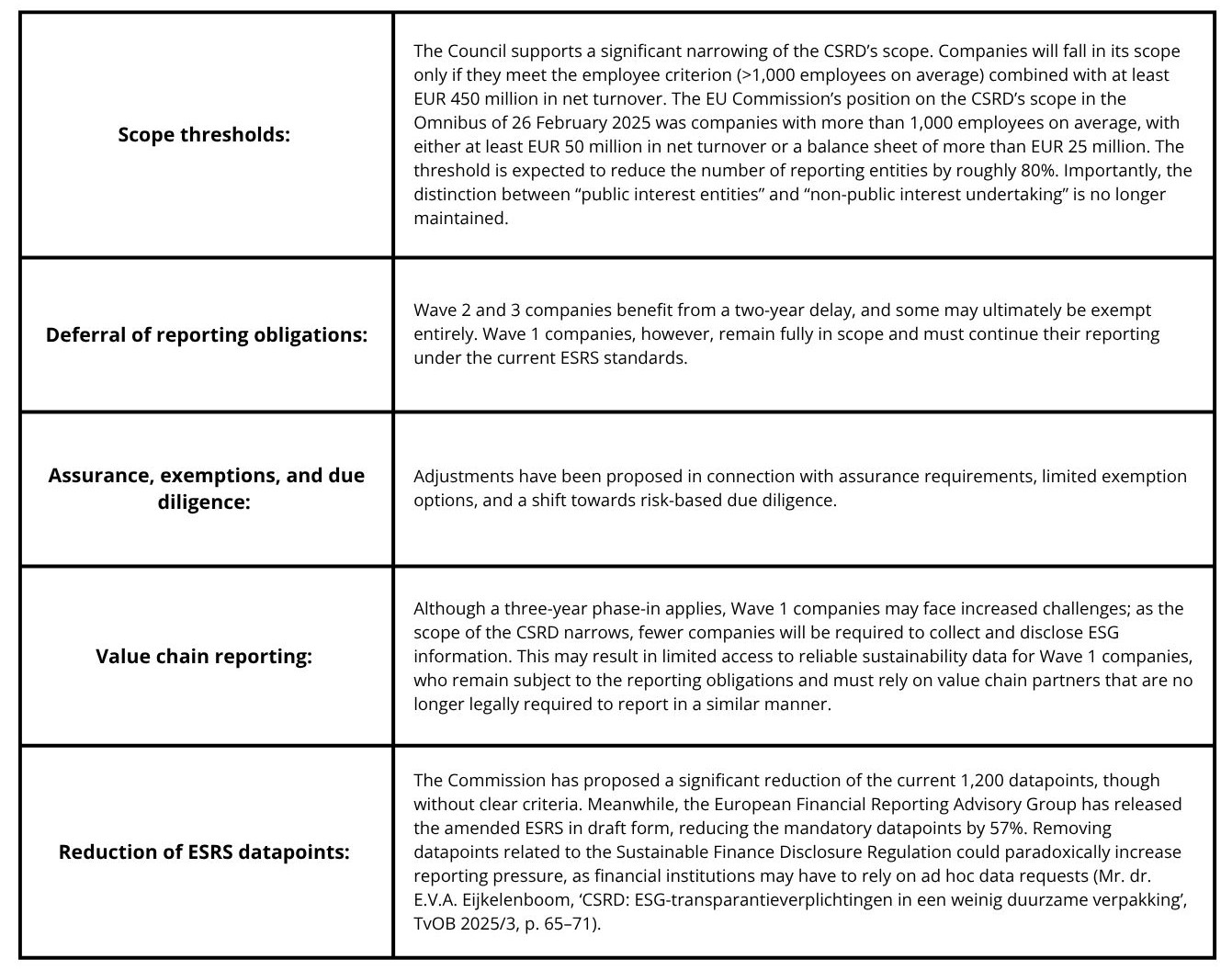

The Council has adopted its final position on the Omnibus package. The most notable elements are:

On 13 October 2025, the Legal Affairs Committee of the European Parliament (the Legal Affairs Committee) approved its negotiating position on the Omnibus I (published in agreed draft text), aiming to further simplify sustainability reporting and due diligence rules under (amongst others) the CSRD. The Legal Affairs Committee endorsed raising the thresholds for in-scope companies, limiting CSRD obligations to EU companies with over 1,000 employees and EUR 450 million in net turnover, and increasing thresholds for non-EU companies. It also supported a “value chain cap” restricting the sustainability data that large companies can request from smaller business partners, unless such data is part of voluntary standards or commonly shared in the sector. Further, the Legal Affairs Committee introduced provisions to address data-sharing restrictions under third-country laws, allowing default values when necessary and requiring transparency with regulators. These changes reflect a broader EU effort to reduce administrative burdens while maintaining core sustainability objectives, setting the stage for the negotiations between the Commission, Parliament and Council.

What will happen next?

The legislative process is not finalised yet. During the second half of October 2025, the European Parliament is expected to adopt its final position on the second Omnibus, which also encompasses adjustments to the CSRD, CSDDD and the EU Taxonomy Regulation. Negotiations between the Commission, Parliament and Council are anticipated thereafter, with final agreement likely by the end of 2025 or early 2026.

For companies, this means uncertainty. Wave 1 entities must maintain their compliance efforts, while Wave 2 and 3 companies may justifiably pause or recalibrate their preparations. The direction is clear: fewer companies in scope, fewer datapoints, and a stronger focus on risk-based and proportionate reporting. We will continue to closely monitor and keep you updated on the legislative process in Brussels.

Update of the blog dated 16 October: in the vote of 22 October, the European Parliament rejected the negotiating basis on the terms approved by the Legal Affairs Committee. This means that the Omnibus proposal will now be considered by the European Parliament during the next plenary session on 13 November. It gives Members of Parliament the opportunity to propose further amendments to the Omnibus text in advance of the final vote. Therefore, the negotiating position – in advance of the trilogue negotiations between the Commission, Parliament and Council – may differ from the position set out by the Legal Affairs Committee, creating a prolonged uncertainty.

Following the plenary session of the European Parliament on 13 November, we will know the timeline for amendments to be submitted. These amendments may encompass further changes to the anticipated position on the CSRD, CSDDD and the EU Taxonomy Regulation. Negotiations between the Commission, Parliament and Council are anticipated thereafter. While the objective remains to reach final agreement by the end of 2025 or early 2026, the timeline is becoming increasingly constrained, and the European Parliament’s position remains unclear. We will continue to closely monitor the legislative process in Brussels.

Introduction

The EU Green Deal continues to be reshaped through a series of legislative revisions. One of the revisions relates to the Corporate Sustainability Reporting Directive (CSRD). As a short recap, early 2025, the European Commission published the two “Omnibus” packages, intended to adjust both timelines and certain substantive obligations across the EU Green Deal frameworks (see i and ii).

On 14 April 2025, the “Stop-the-Clock” Omnibus Directive was formally adopted. This granted a two-year deferral to the companies that needed to report in Wave 2 and Wave 3. On 23 June 2025, the Council of the European Union (the Council) adopted its final position on the second Omnibus proposal.

Earlier, we provided an overview of the most relevant proposed amendments to the CSRD and CSDDD resulting from the Stop-the-Clock Proposal. In this ESG update, we will (i) concisely address the most important items of the final position of the Council regarding the CSRD and (ii) focus on the differences between the Stop-the-Clock Proposal and the Council’s final position. The Council’s final position is to be considered a formal response to the EU Commission’s second Omnibus proposal.

The Council’s Final Position and Thresholds

The Council has adopted its final position on the Omnibus package. The most notable elements are:

On 13 October 2025, the Legal Affairs Committee of the European Parliament (the Legal Affairs Committee) approved its negotiating position on the Omnibus I (published in agreed draft text), aiming to further simplify sustainability reporting and due diligence rules under (amongst others) the CSRD. The Legal Affairs Committee endorsed raising the thresholds for in-scope companies, limiting CSRD obligations to EU companies with over 1,000 employees and EUR 450 million in net turnover, and increasing thresholds for non-EU companies. It also supported a “value chain cap” restricting the sustainability data that large companies can request from smaller business partners, unless such data is part of voluntary standards or commonly shared in the sector. Further, the Legal Affairs Committee introduced provisions to address data-sharing restrictions under third-country laws, allowing default values when necessary and requiring transparency with regulators. These changes reflect a broader EU effort to reduce administrative burdens while maintaining core sustainability objectives, setting the stage for the negotiations between the Commission, Parliament and Council.

What will happen next?

The legislative process is not finalised yet. During the second half of October 2025, the European Parliament is expected to adopt its final position on the second Omnibus, which also encompasses adjustments to the CSRD, CSDDD and the EU Taxonomy Regulation. Negotiations between the Commission, Parliament and Council are anticipated thereafter, with final agreement likely by the end of 2025 or early 2026.

For companies, this means uncertainty. Wave 1 entities must maintain their compliance efforts, while Wave 2 and 3 companies may justifiably pause or recalibrate their preparations. The direction is clear: fewer companies in scope, fewer datapoints, and a stronger focus on risk-based and proportionate reporting. We will continue to closely monitor and keep you updated on the legislative process in Brussels.